Business Intelligence Solution to Improve Cash Flow Management

Struggling to boost cash flow?

One silent troublemaker that erodes cash flow is clients paying too late. If you can identify customers that continuously pay overdue, you could increase the cash flow by, for example, offering early payment discounts or negotiating payment terms.

How do you know if it’s the right time to implement such initiatives in your organization?

Finance analytics and tools like Power BI provide invaluable support in such situations.

However, many struggle with deriving insights from data:

“I can’t trust this data, it’s so inaccurate!”

If you’re also interested in becoming data-driven, here’s an example of a business intelligence solution helping you make informed decisions to improve the payment period.

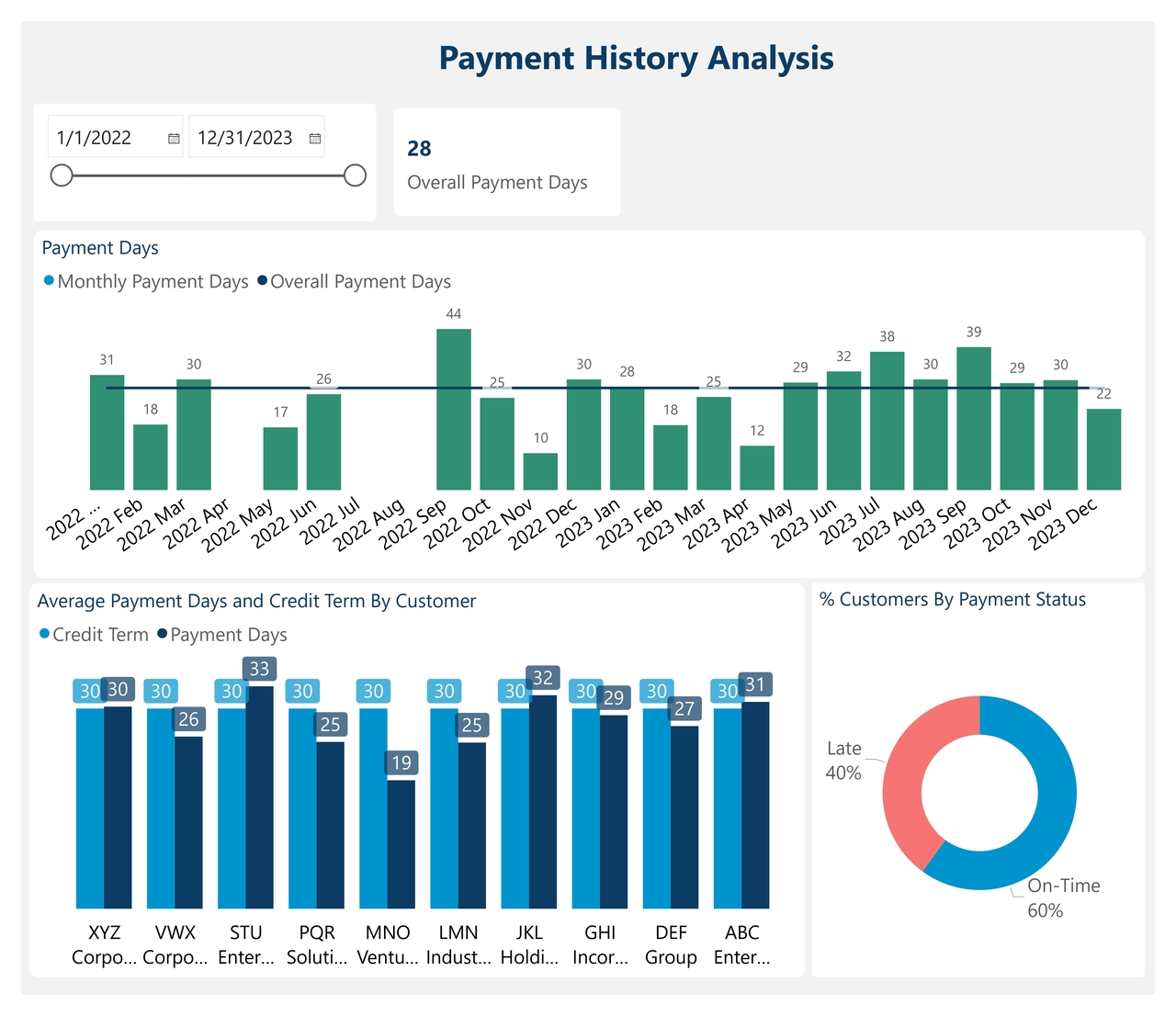

Payment History Analysis Report

The report works in the following way:

Data collection: The report automatically pulls invoice and payment days for each customer.

Data model: In the backend, it compares the expected payment date to the actual payment date by identifying customers that continuously pay too late.

Here is how you can use such a report:

Identify Slow Paying Customers: In the bottom chart, you can compare the credit terms with payment days for each customer (the two bars side by side). For example, customer XYZ Corporation pays invoices within 39 days, while the due period is 30 days.

Discover Payment Patterns: Using the top chart, you can identify the seasonality of payment trends. The dark horizontal line indicates the overall payment days, while the bars indicate the payment days in each month. In the months when the bars exceed the line, the firm receives the money too late. For example, the data in the report shows that the months of February or July experience higher payment periods.

This analysis, facilitated by finance analytics and Power BI, allows finance leaders to reach out to customers like MNO Ventures to tighten credit terms. Another initiative to improve cash flow is to offer a discount on invoices issued during months of February, March and July.

Want faster, smarter insights from your data?

Book a quick 30-minute call to explore how I can support your organization’s goals.